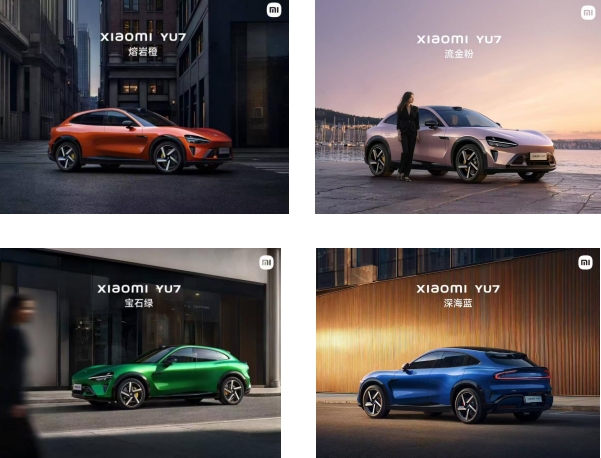

On June 26, 2025, Xiaomi made automotive history with the launch of its first electric SUV, the YU7 (御7), shattering global sales records within minutes. The vehicle’s 3-minute pre-order volume exceeded 200,000 units, and within an hour, orders surged to 289,000, eclipsing even Tesla’s best-performing models in China. This unprecedented demand underscores Xiaomi’s rapid rise as a formidable player in the EV market, leveraging its strong brand ecosystem, aggressive pricing, and cutting-edge technology.

1. Product Specifications & Competitive Pricing

The Xiaomi YU7 is positioned as a "luxury high-performance SUV", featuring:

- 800V SiC ultra-fast charging (15-minute charge for 620 km range)

- CLTC range of 835 km (standard version), surpassing Tesla Model Y’s 593 km

- Tri-motor Max variant with 691 HP, accelerating from 0-100 km/h in 3.23 seconds

- Laser radar, NVIDIA Thor AI chip (700 TOPS), and Xiaomi’s proprietary HyperOS integration

Pricing was strategically set to undercut Tesla:

- Standard RWD: ¥253,500 (~$35,000)

- Pro AWD: ¥279,900 (~$38,500)

- Max Performance AWD: ¥329,900 (~$45,500)

This "flagship specs at mid-range pricing" approach earned the YU7 the nickname "the king of cost-performance".

2. Market Positioning & Competitive Edge

Xiaomi CEO Lei Jun directly compared the YU7 to the Tesla Model Y, highlighting:

- Longer range (+242 km)

- Faster charging (5.2C vs. Tesla’s 3C)

- More premium interior features (including a panoramic 1.1-meter HUD display)

The "full-stack high-end standard" strategy—where even the base model includes laser radar, 800V architecture, and adaptive suspension—disrupted the industry’s typical "pay-to-upgrade" model.

1. Unprecedented Demand

- 3 minutes: 200,000 pre-orders (with 122,000 locked-in non-refundable deposits)

- 1 hour: 289,000 orders, nearing Xiaomi’s annual production capacity of 300,000 units

- First-day sales revenue: Approx. ¥100 billion (~$13.8 billion)

By comparison:

- Tesla Model Y (2025 refresh): Only 50,000 pre-orders on launch day

- Xiaomi SU7 (2024 sedan): 88,900 orders in 24 hours—now dwarfed by the YU7’s explosive demand.

2. Factors Driving the Sales Surge

(a) Ecosystem Synergy & Brand Loyalty

- Xiaomi’s 1.1 billion global MIUI users provided a massive conversion funnel.

- Buyers received ¥66,000 (~$9,100) in launch perks, including free Nappa leather seats and lifetime ADAS services.

(b) Aggressive Pricing & High-End Standardization

- Unlike Tesla, which charges extra for FSD and premium interiors, Xiaomi made premium features standard, forcing rivals to reconsider their pricing models.

(c) Strong Pre-Launch Hype

- The YU7’s reservation volume was 3x higher than the SU7’s at the same stage, reflecting growing consumer trust in Xiaomi’s automotive ambitions.

1. Tesla’s Market Share Under Threat

- Tesla’s Model Y sold ~126,600 units in China in the first five months of 2025, but the YU7’s single-day orders surpassed two years of Model Y sales.

- Tesla’s stock dropped 3.79% post-launch, erasing ~$40 billion in market cap.

2. Chinese EV Makers Adjust Strategies

- NIO, Xpeng, and Li Auto reportedly accelerated their SUV launches to counter Xiaomi’s dominance.

- Lantu Auto’s executive controversially dismissed Xiaomi as "a bubble tea brand", reflecting industry anxiety.

1. Production & Delivery Bottlenecks

- Xiaomi’s current annual capacity is 300,000 vehicles, but with SU7 and YU7 sharing production lines, some buyers may wait until 2026 for delivery.

- Scalpers exploited demand, reselling pre-order slots for ¥2,000-10,000 (~$275-$1,375).

2. Data Authenticity Concerns

- Rumors of "350,000 orders in 5 minutes" were debunked by Xiaomi’s PR head, clarifying the actual conversion rate was ~60% (122,000 locked orders).

3. Long-Term Quality & Safety Assurance

- Xiaomi emphasized 6.49 million km of extreme-condition testing (-41°C to 53°C) to reassure buyers after past SU7 safety concerns.

The YU7’s success validates Xiaomi’s "tech democratization + ecosystem integration" strategy. If Xiaomi can ramp up production and maintain quality, the YU7 could redefine the 25-35k EV SUV segment, much like the iPhone did for smartphones.

Morgan Stanley predicts Xiaomi’s auto revenue could hit ¥1 trillion (~$138 billion) by 2030, with its stock potentially reaching HK$100. For now, the YU7’s record-breaking debut marks a pivotal moment—not just for Xiaomi, but for the global EV industry.